The Coffee and Spice Packaging Factory is an industrial facility dedicated to processing and packaging coffee beans and spices. The coffee undergoes several stages including cleaning, roasting, grinding, and packaging. Similarly, the spices are cleaned and undergo additional stages such as sorting, drying, and grinding before packaging. The project is notable for its increasing demand, ease of product marketing, and potential for future expansion. The Coffee and Spice Packaging Factory caters to a diverse clientele including restaurants, hotels, cafes, supermarkets, hypermarkets, wholesalers, and retailers.

The Coffee and Spice Packaging Factory is an industrial facility dedicated to processing and packaging coffee beans and spices. The coffee undergoes several stages including cleaning, roasting, grinding, and packaging. Similarly, the spices are cleaned and undergo additional stages such as sorting, drying, and grinding before packaging. The project is notable for its increasing demand, ease of product marketing, and potential for future expansion.

The coffee and spice packaging factory targets restaurants, hotels, cafes, supermarket, hypermarket, wholesalers, and retailers.

Mashroo3k for Economic Consulting is pleased to offer specialized services to investors considering investment in a Coffee and Spice Packaging Factory. Our comprehensive and integrated approach encompasses a thorough assessment of the project’s economic feasibility and implementation strategy. We analyze all aspects of the project, including marketing, technical, financial, and administrative considerations, leveraging our extensive database to analyze market indicators and predict future requirements.

Executive Summary

Project Service/Product Study

Market Size Study

Study of Risks

Technical Study

Financial Study

Regulatory and Administrative Study

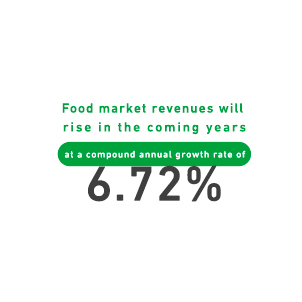

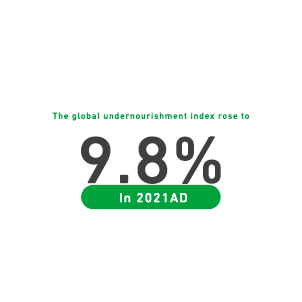

Despite accounting for 0.7% of the global population, the GCC countries account for 3% of the global expenditure on processed food and beverages, with USD 102 billion out of USD 3.4 trillion. This indicates a higher per capita food consumption in the region compared to the global average. This isn’t surprising upon closer examination; the GCC population surpasses 58 million, with approximately 56.3% of them falling within the age bracket of (25 to 54 years old); It is this crucial and dynamic demographic segment that drives the food industries market, being the most vibrant and youthful compared to other age segments

Given Saudi Arabia’s dominance in the GCC region, accounting for approximately 59.7% of the total population, and its commanding share of over 53% in the food and beverage market, “Mashroo3k” has taken the initiative to present the key indicators of this vital market within the Kingdom based on the latest available statistics:

Global Food Industry: