Plastic Medical Supplies Factory is a specialized factory designed to manufacture a wide range of medical supplies made from plastic materials, such as: sterilization bags, medical tubing, oxygen masks, ventilators, sample collection kits, test cups used to test medical samples, and other related products. This factory shows its commitment and dedication to making sure the medical sector gets top-notch products that meet standards. This helps improve healthcare and makes medical services better. The Plastic Medical Supplies Factory project targets hospitals, clinics, laboratories, and physical therapy centers.

Plastic Medical Supplies Factory is a specialized factory designed to manufacture a wide range of medical supplies made from plastic materials, such as: Sterilization bags, medical tubing, oxygen masks, ventilators, sample collection kits, test cups used to test medical samples and other related products. This factory shows its commitment and dedication to making sure the medical sector gets top-notch products that meet standards. This helps improve healthcare and makes medical services better. The Plastic Medical Supplies Factory project targets hospitals, clinics, laboratories, and physical therapy centers

Plastic Medical Supplies Factory provides competitive prices and high-quality products which contributes to gaining the desired share of the target market. Mashroo3k for Economic Consulting expects Plastic Medical Supplies Factory to generate high profits due to the high demand, and the project’s use of the latest technological tools in the production process, in addition to expanding and acquiring on a larger geographical scale.

Executive Summary

Project Service/Product Study

Market Size Study

Study of Risks

The Industrial Sector in the Gulf Cooperation Council countries

The industrial sector stands as a cornerstone in the renaissance of the world economy with its metrics serving as barometers of national progress and development The robustness of the industrial sector in certain Western nations today has played a pivotal role. Given the importance of this sector, Mashroo3k is pleased to present you with the following essential insights into the industrial sector of the Gulf Cooperation Council countries

The Kingdom of Saudi Arabia:

The United Arab Emirates:

Oman:

Kuwait:

Qatar:

Oman:

The Industrial Sector in the Gulf Cooperation Council countries

There are 1801 factories under construction in the Kingdom of Saudi Arabia. The number of licensed workers in these factories is 78,650. . The factories capital is estimated at approximately SAR 68,481 million.

Riyadh accounts for 40.4% with (728 factories) of these under-constructing factories.

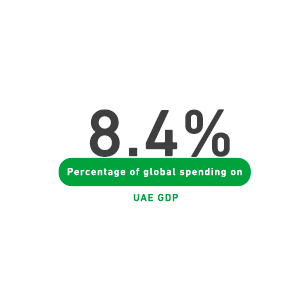

The industrial sector in the UAE contributes about 8.4% to the GDP.

The industrial exports value exceeded AED 240 billion.

The UAE aspires to be ranked 25th in the Global Manufacturing Competitiveness Index, having held 38th place years ago.

The UEA strategy supports the establishment of 13,500 small and medium enterprises.

The industrial sector in the UAE contributes about 8.4% to the GDP.

The number of facilities with more than 20 workers is 549 The number of workers in these facilities reached 129,735. The total production value of these facilities reached KWD 35,566,260 thousand.

Manufacturing industries contribute around 9.2% to the GDP

The number of facilities with less than (10 workers) is 1799 , and the total number of workers in these facilities is 8,305.

The number of facilities with more than (10 workers) is 1668. the total number of workers in these facilities is 153,567.

The manufacturing industries exports account for 31.4% of Oman’s total exports.

The growth rate of manufacturing industries is estimated at approximately 6% over the past five years.