An iron and steel factory is are an investment project revolves around manufacturing and producing various products of iron and steel, including: railway track, pipes, wires, sheets, and plates. The project intends to partially cover the growing demand for iron and steel products, as it promotes the economic growth, reduces the imports, achieves self-sufficiency, creates new job opportunities and reduces unemployment rates. Mashroo3k for Economic Consulting expects such a project to significantly capture its target market share and generate high financial returns.

An iron and steel factory is an investment project revolves around manufacturing and producing various products of iron and steel, including: railway track, pipes, wires, sheets, and plates. The project intends to partially cover the growing demand for iron and steel products, as it promotes the economic growth, reduces the imports, achieves self-sufficiency, creates new job opportunities and reduces unemployment rates. Mashroo3k for Economic Consulting expects such a project to significantly capture its target market share and generate high financial returns.

Mashroo3k for Economic Consulting is pleased to provide a feasibility study for Iron and Steel Factory based on the latest international standards, as it presents the quantity of supply and demand, marketing gap, competitors, analyzing strengths and weaknesses, opportunities, threats, securing raw materials, production line, and financial indicators such as break-even point, payback period, fixed and variable costs, and others; therefore our company “Mashroo3k” for Economic Consulting is the leading provider of certified feasibility studies in the Middle East.

Executive Summary

Project Service/Product Study

Market Size Study

Study of Risks

Technical Study

Financial Study

Regulatory and Administrative Study

Given to the significance of such sector, Mashroo3k is pleased to show you the following key indicators in the GCC countries:

The GDP value of building and construction sector in Saudi Arabia is estimated at SAR 168,750 million.

The sector contributes 48.2% to Saudi GDP.

The number of companies operating in this sector is about 148,026.

The number of workers in this sector is about 3,541,977.

According to the latest statistics, the value of completed projects in the sector is SAR 311,563,369 thousand.

Saudi Arabia comes first as the largest construction market in the region, with an annual market value surpassing USD 100 billion.

The GDP value of building and construction sector is estimated at AED 123,953 million.

The sector contributes 8.3% to the GDP.

The number of companies operating in this sector is about 42,428.

The number of workers in this sector in the UAE is about 1,564,095.

The GDP value of building and construction sector is estimated at BHD 936.79 million.

The sector contributes 7.70% to the GDP.

In 2016, the sector value did not exceed BHD 857 million. However, within a few short years, the sector value has surged to BHD 945.51 million.

The GDP value of the sector is estimated at OMR 936.79 million.

The sector contributes 6.7% to the GDP.

The number of workers in this sector is about 548,999.

Oman’s construction sector has the largest share of workforce, with (22.4% of all Omani workers in both private and public sectors).

It also accounts for 29.6% of the total number of expatriate workers in the Sultanate.

The GDP value of building and construction sector is estimated at KWD 838.9 million.

The sector contributes 2.14% to the GDP.

The number of companies operating in this sector is about 1502.

The number of workers in this sector is about 187,705.

The GDP value of building and construction sector is estimated at QAR 81,215 million.

The sector contributes 12.1% to the GDP.

The number of companies operating in this sector is about 5,629.

The number of workers in this sector is about 840,999.

Over 40% of economically active people works in construction.

The building and construction sector holds great promise, The expanding population and ongoing infrastructure developments across many countries are positioning this sector as a key focus for investors and entrepreneurs aiming for substantial returns with Experts are expected the construction market to grow up to 4.2% in three years, as the indicators shows that the value of this market will surge up to USD 10.5 % trillion by 2023

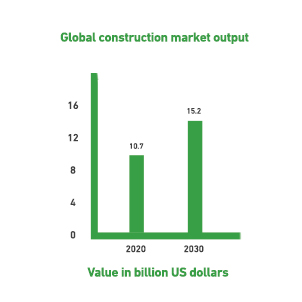

The global building and construction outputs 10.7 trillion in 2020. This output is expected to experience significant growth of 42% (USD 4.5 trillion) between 2020 and 2030, reaching a significant value of USD 15.2 trillion by the end of the decade.

The building and construction sector accounts for 13% of the global GDP, as well as it’s expected to reach 13.5% by 2030. According to the latest statistics, infrastructure will be the fastest-growing subsector within the construction sector, with an anticipated growth rate of 4% between (2020 and 2030).