The Entertainment Complex is a project, aiming to provide visitors with a comprehensive and diverse entertainment experience. The complex includes a large shopping mall, along with a selection of fine dining and fast-food restaurants, cinemas, and facilities for family entertainment and play. Due to the high demand for entertainment services, the diverse target age groups, and the potential for future expansion of the project, the project economic feasibility is assured.

The Entertainment Complex is a project aiming to provide visitors with a comprehensive and diverse entertainment experience. The complex includes a large shopping mall, along with a selection of fine dining and fast-food restaurants, cinemas, and facilities for family entertainment and play. Due to the high demand for entertainment services, the diverse target age groups, and the potential for future expansion of the project, the project economic feasibility is assured.

Mashroo3k for Consulting is pleased to provide a specialized feasibility study based on a vast database covering all aspects of the target market for entrepreneurs looking to invest in an Entertainment Complex. The study we provide intends to guide the investment decision correctly through comprehensive analyses of competitors, consumers, market gaps, supply and demand, as well as presenting the project opportunities and challenges. Additionally, the study covers important technical aspects such as location, infrastructure and standard specifications. It also delves into financial aspects, including cost and revenue calculations, cash flow volume, internal rate of return, payback period, break-even point and other indicators essential to every investor. Therefore, Mashroo3k is the best choice for providing such a study with a systematic approach in the Arab world.

Executive Summary

Project Service/Product Study

Market Size Study

Study of Risks

Technical Study

Financial Study

Regulatory and Administrative Study

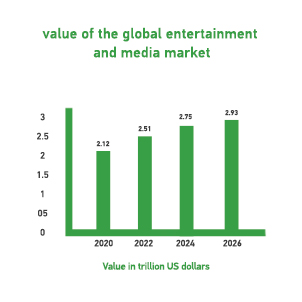

Believing in the role of the entertainment sector in building non-rent economies, Mashroo3k for Economic and Administrative Consulting will present the most important indicators of the sector in the GCC countries below: According to the latest statistics, the number of museums in the GCC countries is 306. The total number of visitors to these museums has reached 6,032,840 visitors. 306. The number of hotel facilities in the GCC countries is 11,119.

The number of entertainment events reached 690, equivalent to 9,784 days. However, the number of people attending these events reached 34,699,458. The number of archeology, history and heritage museums is 33. The number of private museums is 195. There are 8499 archaeological sites; the number of permits to visit these sites is 178,020 (annually). The entertainment sector is expected to participate in the Saudi GDP by 4.2% in the coming years.

According to the latest statistics, the number of museums reached 41. The number of visitors to these museums has reached 2,322,807. The number of public parks is 260.

The number of museums reached 12. However, the number of visitors to these museums reaches 408,000 per day. In the Sultanate of Oman, there are 51 castles and fortresses; the number of visitors to these castles and fortresses has reached 427,000.

When looking at the State of Qatar, we will find that its sports facilities have reached 291, the most of which have been found to be football fields, reaching 90 fields; followed by indoor halls with about 37 halls. The number of cinemas is 99, with a capacity of 14,108 seats. However, the number of films shown in these cinemas reached 3,549, according to the latest statistics. The annual total number of visitors to museums and exhibitions in Qatar reaches 1,038,470 individuals.

The number of entrepreneurs of the Kuwait Touristic Enterprises Company, which provides a lot of entertainment and recreational services, has reached 1,308,514 individuals. The number of visitors to museums in Kuwait has reached 108,987 individuals. Kuwait has 814 libraries; the number of classified books reaches 2,087,513. The GCC governments have sought to improve the quality of life and provide a high level of well-being for the residents of the region. These governments have aimed to achieve this by investing in the entertainment sector to fulfill their objectives. In recent years, we have witnessed how these governments adopted initiatives aimed at increasing the number of parks and live entertainment shows and promoting visual and auditory arts.

Mashroo3k Consulting Company recommends investing in the entertainment sector for the following reasons: