A media production project is a vital initiative that contributes to the development of creative content and enhances the entertainment and media industry. The project aims to provide comprehensive services that support creators and artists in transforming their ideas into professional works that meet audience expectations. These services include developing artistic concepts, scriptwriting, scene filming, audio recording, casting actors and performers, and providing qualified technical crews. The project is highly flexible in producing diverse content, including films, TV series, television and radio programs, commercials, marketing and educational videos, and even animated productions. The project opens vast opportunities for innovation, focusing on delivering fresh content that keeps up with modern trends. It represents a promising investment opportunity due to the increasing demand for high-quality artistic content. Beyond supporting artists, the project contributes to the growth of the media and entertainment sector, making it a successful model that blends creativity and professionalism to achieve sustainable financial returns.

A media production project stands out for its ability to add significant value to the creative industry by assembling a specialized team with expertise and skills across various production fields. The project leverages the latest technologies and tools to ensure high quality at every stage of the process, enabling the production of outstanding content that meets audience expectations.

The project focuses on adopting innovative and fresh ideas that bring a unique touch to artistic productions while relying on effective management to achieve goals efficiently. One of its key strengths is the diversity of services offered, including the production of films, series, programs, and advertisements, aligning with market demands.

Moreover, the project places great emphasis on building strong relationships with distributors, ensuring that its artistic works reach a broad audience. With this integrated approach, the project can cater to diverse tastes, making it highly competitive in the market and capable of achieving long-term success.

Executive Summary

Project Service/Product Study

Market Size Study

Study of Risks

Technical Study

Financial Study

Regulatory and Administrative Study

Service Sector in the GCC Countries

According to macroeconomic sector theory, the economy is typically categorized into three primary sectors: The first involves the extraction of raw materials, encompassing industries like mining, timber, oil exploration, as well as agro-industries and fisheries. The second sector involves the production and sale of goods, including industries such as automotive manufacturing, furniture, and clothing trade. Conversely, the third sector, known as the “service” sector, focuses on providing intangible services, such as entertainment, healthcare, transportation, hospitality, and restaurants. As countries progress, their economies tend to shift towards greater reliance on the service sector, in contrast to less developed countries where the primary sector predominates. For instance, in the United States, the service sector accounts for 85% of its economy.

The Kingdom of Saudi Arabia:

Qatar:

Kuwait:

The United Arab Emirates:

Oman:

The Global Service Sector

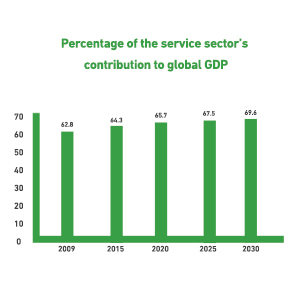

The service sector is the major contributor to the global GDP; it alone accounts for more than three fifths of this GDP. The sector does not rely on producing tangible goods such as vehicles and furniture, but rather on providing intangible services such as banking, medical care, transportation, hospitality, entertainment, etc. The value of the sector market was estimated in 2020 at USD 10,814.49 billion and rose to USD 11,780.11 billion in 2021. Therefore, the market achieved a CAGR of 8.9%. After recovering from the effects of the corona virus pandemic, global market experts expect the sector market to reach USD15683.84 billion by 2025, bringing the market to a CAGR of 7% in the coming years.

Mashroo3k for Consulting recommends investing in the services industry, as its contribution to the GDP rose from 62.8% in 2010 to 65.7% in 2020. According to World Bank data, the contribution of this industry to the GDP is expected to rise to 69.6% by the year 2030.