An Exchange Company is a project that offers a wide array of financial services, encompassing foreign currency exchange, money transfer facilitation, cashing traveler’s checks, and related amenities. Its importance is underscored by its role in promoting financial inclusivity, facilitating global trade transactions, and supporting the travel and tourism industries. Additionally, the project aims to streamline cash liquidity provision for individuals and businesses, thus bolstering financial stability and ensuring client convenience.

An Exchange Company is a project that offers a wide array of financial services, encompassing foreign currency exchange, money transfer facilitation, cashing traveler’s checks, and related amenities. Its importance is underscored by its role in promoting financial inclusivity, facilitating global trade transactions, and supporting the travel and tourism industries. Additionally, the project aims to streamline cash liquidity provision for individuals and businesses, thus bolstering financial stability and ensuring client convenience.

Mashroo3k for Economic Consulting is delighted to offer a feasibility study tailored for an Exchange Company, aiming to ensure the economic viability of this endeavor while adhering to the latest international standards in the field. Our services are defined by meticulous methodology, thoroughness, connectivity, and forward-thinking capabilities, supported by our extensive database covering all Middle Eastern markets. With a team of highly experienced, competent, and professional consultants, we deliver top-notch services at accessible rates to our valued clients.

Executive Summary

Project Service/Product Study

Market Size Study

Study of Risks

Technical Study

Financial Study

Regulatory and Administrative Study

Service Sector in the GCC Countries

According to macroeconomic sector theory, the economy is typically categorized into three primary sectors: The first involves the extraction of raw materials, encompassing industries like mining, timber, oil exploration, as well as agro-industries and fisheries. The second sector involves the production and sale of goods, including industries such as automotive manufacturing, furniture, and clothing trade. Conversely, the third sector, known as the “service” sector, focuses on providing intangible services, such as entertainment, healthcare, transportation, hospitality, and restaurants. As countries progress, their economies tend to shift towards greater reliance on the service sector, in contrast to less developed countries where the primary sector predominates. For instance, in the United States, the service sector accounts for 85% of its economy.

The Kingdom of Saudi Arabia:

Qatar:

Kuwait:

The United Arab Emirates:

Oman:

The Global Service Sector

The service sector is the major contributor to the global GDP; it alone accounts for more than three fifths of this GDP. The sector does not rely on producing tangible goods such as vehicles and furniture, but rather on providing intangible services such as banking, medical care, transportation, hospitality, entertainment, etc. The value of the sector market was estimated in 2020 at USD 10,814.49 billion and rose to USD 11,780.11 billion in 2021. Therefore, the market achieved a CAGR of 8.9%. After recovering from the effects of the corona virus pandemic, global market experts expect the sector market to reach USD15683.84 billion by 2025, bringing the market to a CAGR of 7% in the coming years.

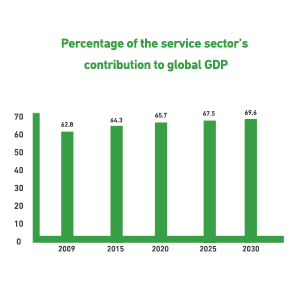

Mashroo3k for Consulting recommends investing in the services industry, as its contribution to the GDP rose from 62.8% in 2010 to 65.7% in 2020. According to World Bank data, the contribution of this industry to the GDP is expected to rise to 69.6% by the year 2030.