Mashroo3k Consulting provides a feasibility study for a money exchange company project, aimed at achieving the highest profitability and the best payback period. The study includes detailed analyses of the service sector in the target market, evaluations of local and international competitor strategies, and the development of competitive pricing offers.

The exchange company provides services for buying and selling different currencies, and exchanging foreign currencies for local currency or vice versa. The exchange company is of increasing importance in capitals and vital cities, and in airports and ports, as the exchange company’s services target incoming tourists, and those preparing to travel outside the country, and is one of the promising investment opportunities in Egypt, in light of the recent tourism boom.

Mashroo3k Consulting offers specialized feasibility studies for investors interested in establishing a money exchange company. These studies are based on updated databases specific to the target market, ensuring the project’s success and helping achieve the highest profitability and the best payback period.

Executive summary

Study of project services/products

Market Size Analysis.

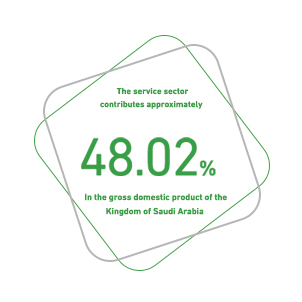

Service sector in GCC countries

According to the macroeconomic theory of sectors, the economy is divided into three main and large sectors: the first; – is the sector that is based on collecting raw materials and includes mining companies, timber companies, oil exploration companies, in addition to agricultural and fishing industries. The second sector; is the sector that depends on goods and their sale, such as: (car manufacturing, furniture, clothing trade… etc.). As for the third sector, known as the “services” sector; it is the sector responsible for providing and producing services, essentially relying on intangible things, such as: entertainment, health care, transportation, hospitality, restaurants, etc. This theory believes that the more advanced countries are, the more their economies are based on the third sector, unlike primitive countries, which rely mostly on the first sector (the United States of America, for example, the service sector constitutes 85% of its economy).

Kingdom of Saudi Arabia:

The State of Qatar:

Kuwait:

United Arab Emirates:

Sultanate of Oman:

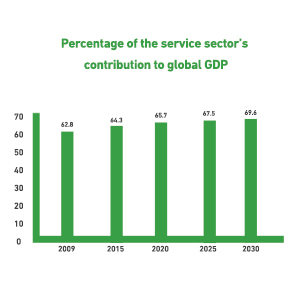

Global Service Sector

The service sector is the major contributor to the world’s gross product; It alone accounts for more than three fifths of this output. The sector does not rely on the production of tangible goods such as automobile and furniture, but rather on the provision of intangible services such as banking, medical care, transportation, hospitality, leisure, etc. The value of the sector market was estimated in 2020 at USD 10,814.49 billion and rose to USD 11,780.11 billion in 2021. The market achieved a CAGR of 8.9%. After recovering from the effects of the coronavirus pandemic, global market experts expect the sector’s market to reach US $ 15683.84 billion by 2025, bringing the market to a CAGR of 7% in the coming years.