Tourism Investment Company is an investment enterprise that establishes, operates, develops, and manages various projects within the tourism sector, including hotels, resort, tourist villages, and others. The significance of the tourism investment company lies in fostering the tourism sector, enhancing its revenue streams, contributing to the country’s GDP, improving infrastructure, and creating new job opportunities, consequently reducing unemployment rates.

Tourism Investment Company is an investment enterprise that establishes, operates, develops, and manages various projects within the tourism sector, including hotels, resort, tourist villages, and others. The significance of the tourism investment company lies in fostering the tourism sector, enhancing its revenue streams, contributing to the country’s GDP, improving infrastructure, and creating new job opportunities, consequently reducing unemployment rates.

The feasibility study provided by Mashroo3k for Economic Consulting is regarded as a thorough analytical process based on local and global data, figures and indicators that used for evaluating the economic feasibility of the tourism investment company project. It contributes to analyzing all the factors that affect the project’s success, starting from market research and competitive analysis, all the way to estimating costs and revenue expectations. Therefore, it is regarded as a vital tool for making well-informed investment decisions and ensuring the long-term sustainability of the project

Executive Summary

Project Service/Product Study

Market Size Study

Study of Risks

Technical Study

Financial Study

Regulatory and Administrative Study

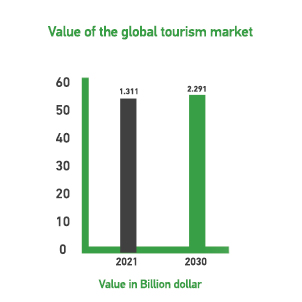

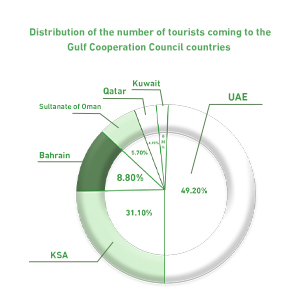

Tourism Sector in the GCC Countries The Tourism Sector stands as a pivotal contributor to the global economy, directly constituting 3.3% of the total global GDP. Its cumulative contribution amounts to 10.4%, equating to USD 9.2 trillion. The sector supports approximately 334 million jobs, representing 10.6% of all employment. Furthermore, global spending on leisure travel is estimated at USD 2.37 trillion. Notably, the tourism sector’s rapid expansion is evident, with one in every four new jobs worldwide being created within this industry. This encapsulates a succinct overview of the key indicators within the global tourism sector. Now, let’s delve into the sector indicators across the GCC Countries: