E-Pharmacy is an online system project that connects customers and pharmacies, providing them with the ability to order medications and pharmaceutical supplies from anywhere and at the fastest possible time. The app offers all the available products in each pharmacy in detail such as: Medication name, dosage, manufacturer, and price. This allows customers to compare prices and products, and order what suits them.

E-Pharmacy is an online system project that connects customers and pharmacies, providing them with the ability to order medications and pharmaceutical supplies from anywhere and at the fastest possible time. The app offers all the available products in each pharmacy in detail such as: Medication name, dosage, manufacturer, and price. This allows customers to compare prices

and products, and order what suits them.

Mashroo3k for Economic Consulting is pleased to provide a feasibility study for an E-Pharmacy app based on the latest international standards in this domain. Our services are characterized by methodology, comprehensiveness, connectivity, and the ability to anticipate the future due to our massive database that covers all the markets in the Middle East, as we have a team of consultants with extensive experience, competence, and professionalism.

Executive Summary

Project Service/Product Study

Market Size Study

Study of Risks

Technical Study

Financial Study

Regulatory and Administrative Study

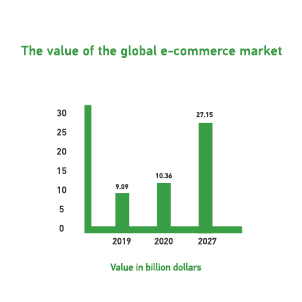

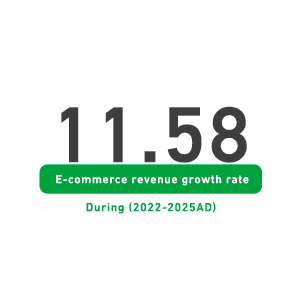

Overview of the statistics of E-commerce in the GCC countries: