The Plastic Recycling Plant is an industrial facility that shifts the plastic waste into materials used in producing new plastic products. This process typically involves several stages, including: collecting used plastic materials, sorting, washing and grinding, then shifting these materials into small granules and finally the extrusion process. The project significance lies in reducing the waste volume, saving energy and natural resources, and curbing pollution and greenhouse gas emissions.

The Plastic Recycling Plant is an industrial facility that shifts the plastic waste into materials used in producing new plastic products. This process typically involves several stages, including: collecting used plastic materials, sorting, washing and grinding, then shifting these materials into small granules and finally the extrusion process

The project significance lies in reducing the waste volume, saving energy and natural resources, and curbing pollution and greenhouse gas emissions

Mashroo3k for Economic Consulting is pleased to provide comprehensive feasibility studies based on a vast database covering all the Middle East markets. Our company provides precise analyses explaining the competitors and their strategies, strengths, weaknesses, and potential opportunities and threats. Our company has a professional, experienced, and efficient consulting team helping clients to make their informed and right decisions

Plastic bags

Containers

Glasses

Plastic furniture and chairs

Toys

Household items

Executive Summary

Project Service/Product Study

Market Size Study

Study of Risks

Technical Study

Financial Study

Regulatory and Administrative Study

Recycling Sector in the Gulf Cooperation Council

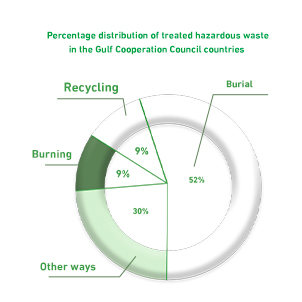

The technological advancements in the GCC countries, as well as population growth, have contributed to increasing the quantity of waste generated from human and industrial activities, etc These represent a real test to the GCC governments; as it has become imperative for the GCC countries to address this issue at a faster pace to avoid environmental and health-related problems. Furthermore, the total accumulated waste quantity (hazardous and non-hazardous) in the GCC countries has been estimated at approximately 131.8 million tons. This waste is distributed with a ratio of (1.2% hazardous waste) and (98.8% non-hazardous waste). Thus, Mashroo3k for Economic and Administrative Consulting would like to present the most important indicators of the recycling sector in the GCC countries below:

Reducing primary energy consumption by about 4%.

Creating 50,000 jobs in the recycling sector.

Reducing the annual carbon dioxide emissions by 13 million tons.

Generating economic returns of USD 138 billion for the GCC countries during 2020-2030.

Recommendations:

Mashroo3k recommends investing in the recycling sector for the following reasons:

The world produces about 2.01 billion tons of solid waste; the volume of these wastes is expected to reach 3.40 billion tons by 2050.

In 2014, the world production of electronic wastes reached 12.8 million metric tons and rose, reaching 53.6 million metric tons in 2019.

Plastic and paper constitute approximately 29% of the total global waste; they are promising sectors for profit if investment is made in them through recycling Here is a division of all waste and its percentage share of total global waste:

Mashroo3k confirms that the waste volume in the Kingdom has exceeded 45 million tons per year. As the Kingdom strives to increase the recycling ratio from 1% to 80% by 2035, the company sees that investment in this vital sector will be significantly profitable. Here are the prospects of the recycling and energy industries

Mashroo3k for Economic Consulting and Market Research confirms that recycling is one of the promising sectors in the Kingdom, as its projects are considered real opportunities for investment, especially after Saudi Arabia’s shift towards the green economy in a way to preserve the environment which is a priority for the wise leadership, which is evident in the Saudi Vision 2030.

Global Recycling Sector

In 2021, the volume of the Global Waste Management Market was estimated at USD 989.20 billion The market is expected to expand at a CAGR of 6.2% from 2022 to 2030; therefore, the market value will reach USD 1685.5 billion at the end of the forecast period. The Middle East and North Africa region is expected to expand in waste recycling and management at a CAGR of 6.3% during the years between 2022 and 2030. This growth is attributed to the increasing awareness regarding the sustainable benefits of waste reuse and recycling. to be overlooked that the fact is the increase in population, rising levels of urbanization, economic growth, and consumption patterns are factors that require encouraging investment in this vital sector